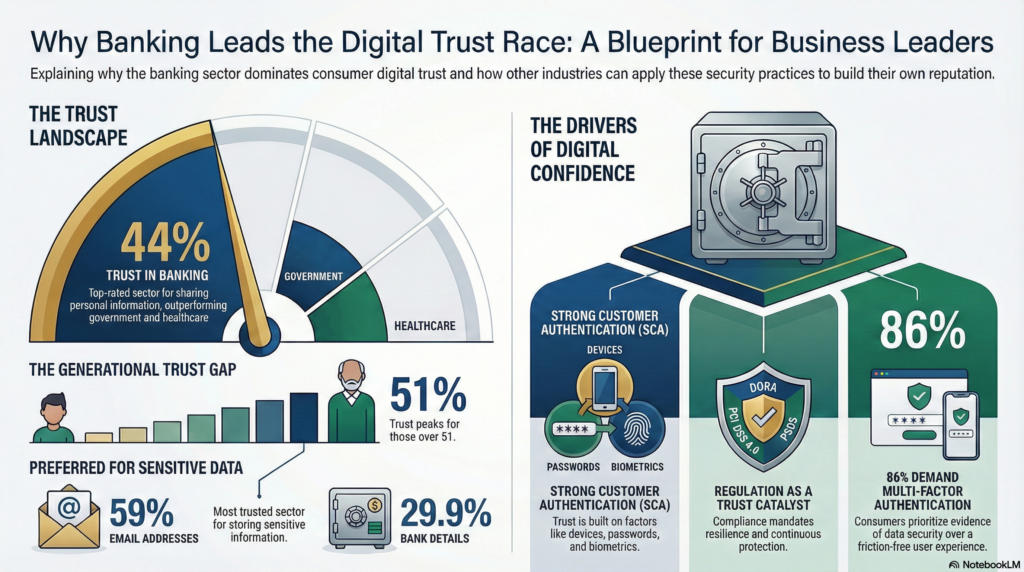

In a lineup of over a dozen listed industries, Banking led the way in the recent Thales 2025 Consumer Digital Trust Index report. With 44% stating that they trust Banking “the most when it comes to sharing [their] personal information,” it becomes evident that the sector is doing something right.

Consumers Trust Banking More Than Any Other Sector

While digital trust across all sectors experienced an unfortunate decline this year, Banking still came out ahead, maintaining a lead on even Government – the only sector that experienced an increase per the report.

The amount of trust increases as respondents get older. Adults over 51 years of age are most likely to trust their information to Banking, as 51% of respondents in this category responded in the affirmative. Banking trust is lowest among individuals aged 16-24, garnering the confidence of a smaller 32%. Respondents in this demographic were slightly more inclined to trust Healthcare (35%) and Government (35%).

This could be because Banking, for many Gen Z-ers, might be heavily mixed in with the image of cryptocurrency, bitcoin, and other blockchain-based entities that have yet to earn a reputation for trustworthiness in the public eye. On the other hand, it can just be because of how challenger banks disrupt the market by offering better experiences than “traditional” banks. Hence, Gen Z simply does not trust the latter because they seem a relic of the past. Interestingly, the level of trust consistently increases as respondents’ ages increase, culminating in the maximum amount of trust in individuals in the highest age bracket.

When asked which types of data respondents would feel safe trusting to certain sectors, the answers are similarly revealing. Out of 5 categories, summarized as Media, Retail & Logistics, Travel, Banking, and Government & Healthcare, Banking was the sector trusted the most with individuals’ email addresses (59%) and bank details (29.9%), and the second-most trusted sector when it came to the sharing of National ID (second only to Government & Healthcare).

Banking Trust: Built on Strong Authentication, Strong Regulation

There are several possible reasons behind the high levels of trust earned by the banking sector this past year.

SCA (Strong Customer Authentication)

First, it is mandated in most jurisdictions that financial institutions utilize SCA (Strong Customer Authentication). SCA requires consumers to use multiple authentication methods when paying online or accessing certain financial services. At least two of the following three “factors” are required for SCA compliance:

- Something you have (device)

- Something you know (PIN or password)

- Something you are (biometrics)

For instance, a user wanting to make a transfer in their mobile banking app may be asked to log in with a username and password and then either enter a passcode sent to their smartphone or unlock the app with biometrics (a facial recognition or fingerprint scan).

A Highly Regulated Industry

Banking is one of the most highly regulated sectors in the world. However, adherence to strict standards may be one of the primary causes of increased levels of consumer trust.

- DORA: The Digital Operational Resilience Act (DORA) unifies cybersecurity guidelines across the financial sector in the EU. It mandates that banks and other financial institutions strengthen their digital resilience through increased security measures so that they can continue to operate despite severe disruptions.

- PCI DSS 4.0: The newly updated Payment Card Industry (PCI) standard requires that all holders and processors of payment card information adhere to a methodology of continuous data protection at every step of the payment process, including encryption, MFA, and vulnerability management.

- PSD3: The Payment Services Directive 3 is a proposed update to the EU’s previous payment services directives (PSD1 and PSD2) and seeks to double down on areas like new forms of fraud and consumer rights while increasing SCA requirements and broadening its scope to e-money institutions.

With such high regulatory and public scrutiny of financial data practices, Banking could capitalize on the increased trust that adherence to these frameworks provides, both in perception and reality.

Security Best Practices for Improving Consumer Trust

As the clear winner of digital trust in this year’s Consumer Digital Trust Index report, Banking may offer some additional best practices to improve consumer confidence across other industries going forward.

- Secure payment processes, for instance, are not only valued in financial services. Sectors from Retail to Hospitality (both subjects of large public breaches in 2024 – see Hot Topic and Otelier) could benefit from strengthening payment security requirements.

- Industry-standard encryption is a must for databases storing payment card information, as well as for transferring sensitive information and storing it at rest in any other form. Whether that be credit card numbers, email addresses, or lab results, any data that could be used to identify an individual should be encrypted by default.

- Multi-factor authentication (MFA) is another necessary must-have for consumer trust, and this year’s report revealed that 86% saw this as an important additional security feature to have on their online accounts. Nearly nine in ten indicated that MFA would even improve their trust in an online brand.

There is always a need to balance increased cybersecurity with user-friendly workflows, and the fear of introducing more friction into the process can be an inhibiting factor. If Banking is any indication, consumers want more evidence of data security and are willing to jump through a few (necessary) hoops to get it. The challenge will be finding solutions that can please and protect customers, because somewhere in the middle lies the measurement of consumer trust.

For more insights on improving consumer confidence in your online brand, read the Thales 2025 Consumer Digital Trust Index report in full.

Ammar is a digital transformation leader specializing in Product Marketing with a focus on B2C Customer Identity and Access Management (CIAM) within the Identity and Access Management (IAM) sector at Thales. He is a recognized thought leader in digital banking and payments, sharing insights at various international conferences and authoring articles for industry publications. When not implementing strong customer authentication and fraud prevention strategies, Ammar enjoys a nice game of cricket!

Additional Resources

Video Overview

Follow Brilliance Security Magazine on LinkedIn to ensure you receive alerts for the most up-to-date security and cybersecurity news and information. BSM is cited as one of Feedspot’s top 10 cybersecurity magazines.