Episode summary

Private credit is often described as direct, collateral-based lending outside traditional banks—and it’s increasingly central to how real estate investors and operating businesses access capital. But as the market has accelerated, many of the underlying controls haven’t kept pace. In Episode S8E1 of the Brilliance Security Magazine Podcast, Steven Bowcut speaks with Cole Snell, founder of Real Private Credit, about why private credit is, at its core, a trust problem—and how that trust can be abused through fraud, data fragmentation, and limited cross-lender visibility.

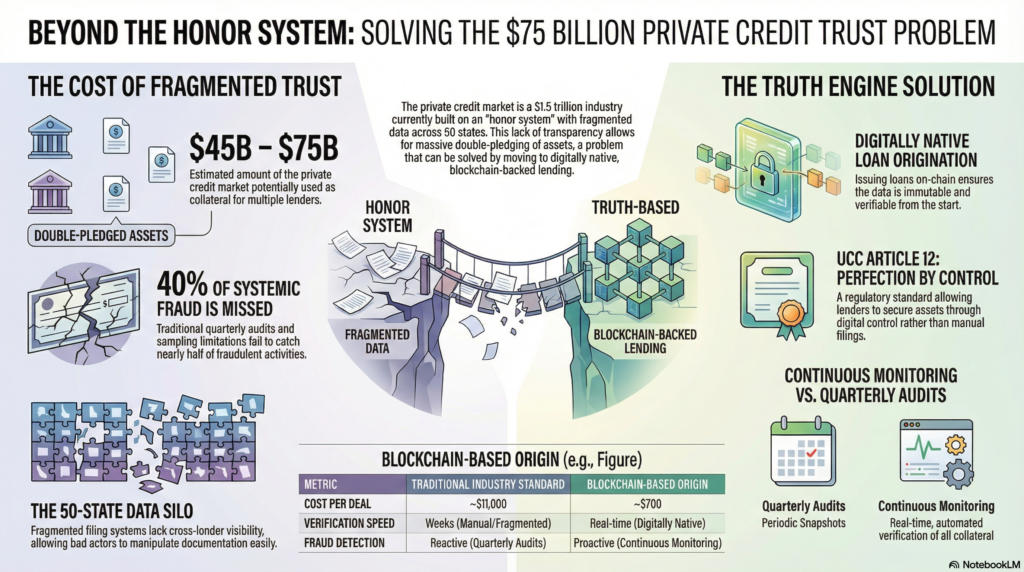

Cole explains (in plain terms) how double-pledging can occur when collateral and lien records are fragmented across state-level filing systems, why quarterly audits can miss meaningful fraud signals, and what “continuous collateral monitoring” looks like in practice. The conversation also explores the role of explainability and audit trails in AI-driven risk scoring, how to reduce automation bias with human-in-the-loop governance, and why Cole believes tokenization can evolve from a detection tool into a preventive control—creating a more verifiable foundation for transacting.

What you’ll learn in this episode

- What “private credit” is—and how it differs from traditional bank lending

- How fraud happens in collateral-based lending, including double-pledging and document manipulation

- Why UCC data fragmentation across 50 states creates blind spots and operational friction

- What an “early warning” approach looks like: continuous monitoring, entity resolution, timing delays, and false positives

- How to keep AI outputs explainable, auditable, and evidence-based—and avoid automation bias

- How Cole frames tokenization as a path toward “truth over trust,” especially when loans are originated digitally native

- Practical controls originators and warehouse lenders can implement over the next 6–12 months

Topics covered

Private credit in plain terms • Asset-backed lending • Fraud patterns and signals • UCC filings and cross-state visibility • Entity resolution and name matching • Timing and workflow risk • Confidence scoring and explainability • Human-in-the-loop governance • Tokenization and digitally native origination • Practical controls for originators and warehouse lenders

About our Guest

Cole Snell is the founder of Real Private Credit, a private lending firm focused on asset-backed loans for real estate investors and operating businesses. He works with borrowers to structure flexible debt solutions while protecting investor capital through disciplined underwriting and a focus on predictable returns. Cole is known for a no-nonsense approach to private credit—focused on real assets, real cash flow, and real risk management.

For cybersecurity and risk professionals, this episode is a reminder that financial fraud often thrives in the same conditions as security incidents: fragmented visibility, inconsistent data, and overreliance on point-in-time checks. Replacing “trust” with verifiable “truth” is not just a finance objective—it’s a control objective.

Click the image below to listen to this Brilliance Security Magazine Podcast episode.

Additional Resource

Video Overview

Infographic Overview

Steven Bowcut is an award-winning journalist covering cyber and physical security. He is an editor and writer for Brilliance Security Magazine as well as other security and non-security online publications. Follow and connect with Steve on LinkedIn.